Monthly Market Commentary – December 2025

Monthly Market Commentary – December 2025

Market Update

Stocks surged in the last week of November on rate cut optimism.

The S&P 500 fell as much as -4.5% in November, but a month-end rally extended its winning streak to seven months. Uncertainty around the timing of rate cuts weighed on stocks earlier in the month, but “dovish” comments from the Fed eased investor concerns.

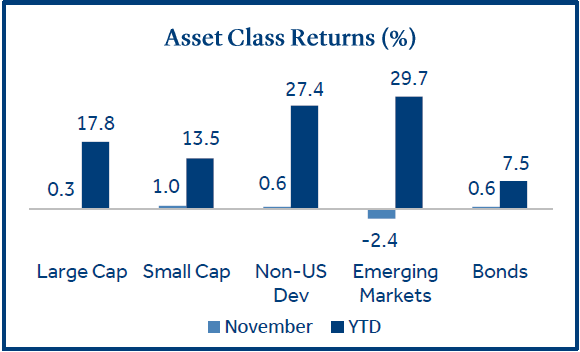

- Small caps gained on rising expectations for a December rate cut: Small caps (Russell 2000) gained +1.0% and outperformed large caps (S&P 500) which returned +0.3%. Greater sensitivity to easing financial conditions fueled gains in small caps.

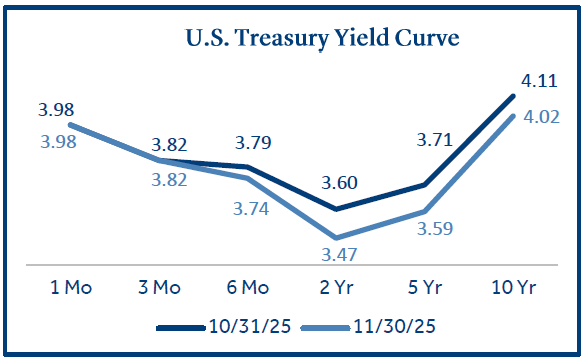

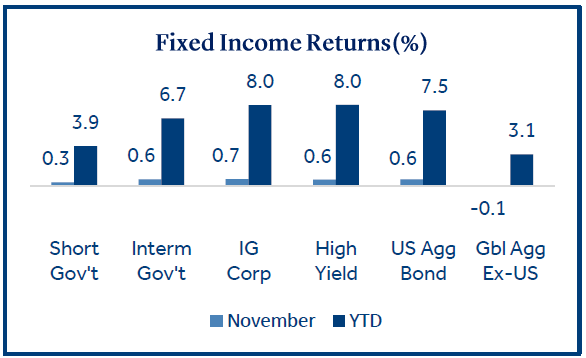

- Bonds anchored portfolios amid November market swings: The Bloomberg US Agg Bond Index gained +0.6% as the 10-year Treasury yield fell from 4.11% to 4.02%. Corporates gained +0.7% while Treasuries and mortgage-backed securities both returned +0.6%.

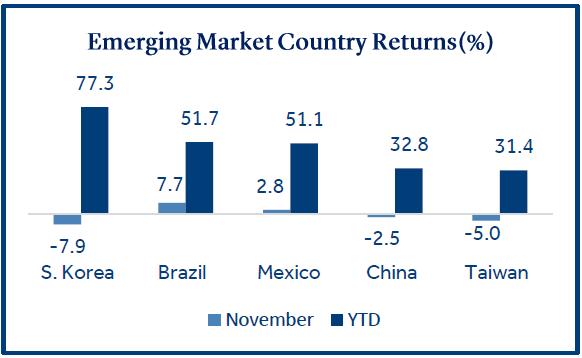

- Emerging markets stalled as the artificial intelligence (AI) investment theme cooled: South Korea (-7.9%) and Taiwan (-5.0%) weighed on EM stocks as the tech sector struggled. Defense spending and fiscal stimulus buoyed European stocks as developed markets (MSCI EAFE) gained +0.6%.

Equities

AI-driven volatility rattled the technology sector in November.

After months of strong gains U.S. tech stocks faced a sharp mid-November decline amid the fears of an AI bubble and stretched valuations. However, strong earnings and revenue guidance from NVIDIA led to a late November rebound which helped curb losses.

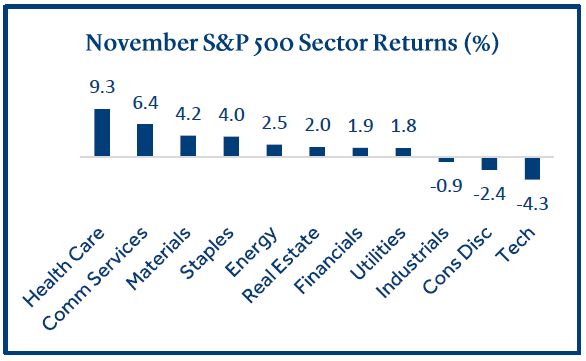

- Investors rotated into defensive sectors for stability: Health care led the charge, extending its resurgence as it is the top performing sector over the past four months (+21%). Other value-oriented and defensive sectors like staples and energy helped buffer portfolio volatility.

- Growth and momentum stocks came under pressure as the AI-driven hype faded: Higher valuation growth stocks, especially those tied to the AI investment theme, faced sharp declines as concerns over monetization timelines and elevated valuations mounted.

- Strong corporate financial results and stock buybacks cushioned the decline: With 95% of S&P 500 firms reporting earnings, average revenue growth was +8.4%, the highest since Q3 20221. Corporate buybacks, led by large cap financials and health care companies, helped support stocks amid declining sentiment.

Fixed Income

Bond yields held steady as investors searched for clarity on the Fed’s next policy move.

Bonds provided stability for portfolios during the month despite shifting signals around a Fed rate cut and limited economic data during the government shutdown period. Higher historical bond yields and demand for stable income underpinned positive flows into fixed income assets.

- Yields traded in a narrow range on limited data: The absence of key economic indicators during the government shutdown kept bond yields in a tight range over the last month.

- Investment grade (IG) corporates led bond returns despite modest spread widening: Credit spreads (or the yield premium for corporates over treasuries) were up slightly during the month. However, higher yields for corporate bonds led to outperformance versus Treasuries.

Emerging Markets

Emerging market stocks are on pace for their best year since 2017.

Emerging market stocks eased slightly in November but continued to lead global equities year-to-date. Gains have been driven by exposure to AI-linked companies, supportive central bank policies, and a weaker U.S. dollar.

- AI-related exposure boosted Asian markets: South Korea’s Samsung has surged on soaring demand for memory chips that power AI data centers. China is driving innovation with the launch of DeepSeek AI, while Taiwan’s Taiwan Semiconductor remains indispensable to the global semiconductor supply chain, producing 90% of the world’s high-performance AI chips2.

- EM stocks benefited from supportive central bank policy and favorable valuations: Brazil rallied on deeply discounted starting valuations and rising expectations for rate cuts as inflation has cooled. Mexico surged following aggressive monetary easing as the Bank of Mexico slashed short-term rates by -2.75% year-to-date.

- A weak dollar has strengthened the financial position for many EM firms: Many emerging market bonds are issued in U.S. dollars and when local currencies strengthen, it becomes cheaper to pay back that debt. This has the potential to improve the financial health and credit quality of these companies.

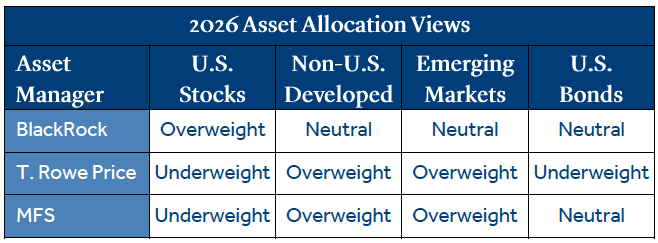

2026 Asset Allocation Views

Asset allocation views are mixed for 2026 but most favor equities over bonds.

Leading asset managers including BlackRock, T. Rowe Price, and MFS recently updated their 2026 asset allocation views which highlight their general preferences for international over domestic stocks.

- BlackRock sees AI boost for U.S. stocks: BlackRock expects market swings and supply issues could slow growth, but progress in AI should help company profits. U.S. stocks look expensive, yet their profitability and strong earnings make them more attractive than other developed market stocks3.

- T. Rowe Price believes persistent inflation could slow bond returns: T. Rowe Price still favors less exposure to U.S. bonds because inflation and government borrowing needs may keep long-term yields elevated. They like inflation-protected bonds, expecting stubborn inflation partly due to tariff policicy4.

- MFS believes structural reforms and tech spending will support international stocks: The EU has made it easier for individuals to invest by removing key barriers, while Japan’s new leader is pushing market reforms and growth-friendly policies. In emerging markets, China’s factory activity beat expectations, and Taiwan and South Korea stand to gain from tech spending and AI infrastructure growth5.

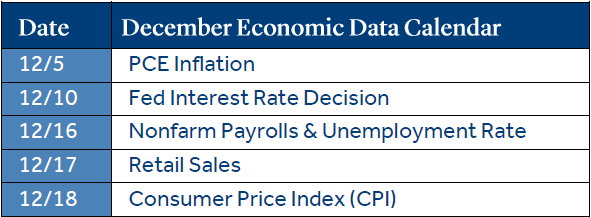

Economic Calendar

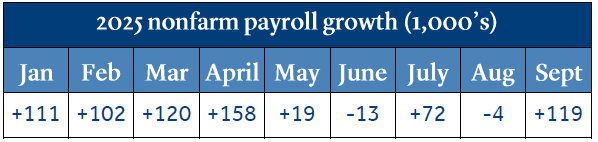

Markets grappled with data delays and slower job growth as the shutdown clouded economic visibility.

November was defined by uncertainty as the 43-day government shutdown period left a “data fog” that complicated economic assessments. Equity markets traded cautiously during the month due to the lack of official economic indicators from October.

- September job growth topped expectations while the unemployment rate rose: Nonfarm payrolls jumped by +119k in September, up from -4k in August and above the forecast for +50k. The data was delayed for six weeks but it provided investors with relief after job growth stalled over the summer. Unemployment edged higher to 4.4%, up from 4.0% in January and the highest level since October 2021.

- The probability of a December Fed rate cut soared in late November: The futures market reflected an 87% probability of a Fed rate cut in December at month end, up from 35% earlier in the month6. The sharp increase was driven by “dovish” comments from key Fed officials, soft retail sales data for September, and the recent rise in the unemployment rate. For investors, a rate cut could be a boost for equities whereas staying pat could disappoint markets and lead to a stronger U.S. dollar.

To download the printable version, CLICK HERE.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Gov’t (Bloomberg Short Treasury), Interm Gov’t (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged).

Treasury Yields sourced from the U.S. Department of the Treasury.

Nonfarm payrolls, unemployment statistics, and inflation (CPI) are sourced from the Department of Labor.

1 Source: FactSet

2 Source: Global Taiwan Institute

3 Source: BlackRock Investment Institute

4 Source: T. Rowe Price

5 Source: MFS Investment Management

6 Source: CME FedWatch Tool

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Fed Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS018119

7069921.19 (Exp. 11/27)