Monthly Market Commentary – February 2026

Monthly Market Commentary – February 2026

Market Update

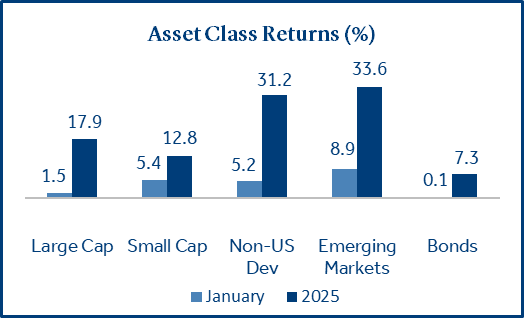

U.S. small cap stocks and emerging markets led asset class returns to kick off 2026.

Stocks proved to be resilient even as geopolitical events dominated headlines in January. Economic data continued to be supportive of risk assets as job growth remained positive, retail sales were better than forecasted and inflation was kept at bay.

- Small caps posted their strongest monthly gain since August: Small cap stocks (Russell 2000) surged +5.4% and outperformed large caps (S&P 500) which gained +1.5%. Small caps benefited from their sensitivity to falling short-term interest rates (lower borrowing costs) and a rotation out of mega-cap tech stocks into more cyclical and domestically focused sectors.

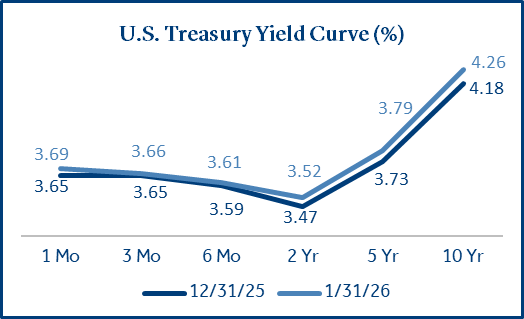

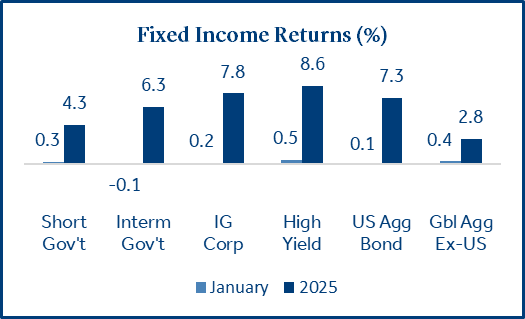

- Bond returns (+0.1%) were muted as rates ticked modestly higher: The Bloomberg US Agg Bond Index was nearly flat as the slight rise in yields offset coupon payments. The 10-year Treasury yield increased +0.08% to 4.26%. Treasuries fell -0.1% while Mortgage-backed securities (+0.4%) and investment grade corporate bonds (+0.2%) both gained.

- Emerging markets (+8.9%) posted strong returns on AI-driven tech surge: Gains in South Korea (+28.1%) and Taiwan (+11.2%) stocks sent EM higher due to their focus on advanced semiconductor manufacturing and global AI infrastructure spending.

Equities

U.S. stocks continued their strong momentum into 2026, but leadership within equities has shifted.

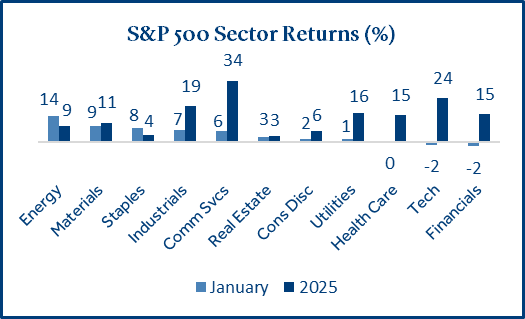

Domestic equities started 2026 on solid footing, underpinned by supportive Fed policy and resilient economic data. Market leadership has shifted from mega-cap technology in 2025 as markets have transitioned to a more balanced environment across market cap size and economic sectors.

- Small caps may benefit from local revenues and lower valuations: In addition to interest rate tailwinds, small caps also derive 77% of their revenues from domestic consumers which helps to protect them from global trade risks1. From a valuation standpoint, small caps trade at 18 times earnings (P/E) while large caps trade at 28 times earnings2.

- Energy surged in January on rising demand, geopolitical tensions, and cold weather: The buildout of AI data centers has driven electricity demand sharply higher. Geopolitical tension in Venezuela and Iran boosted oil prices (+14.3%) while frigid winter temperatures fueled a steep rise in natural gas prices (+39.5%).

- Magnificent seven stocks slowed in January (+0.3%) after a strong 2025 (+23.0%): While fundamentals remained solid, the shift reflects a broader market preference for companies tied to economic growth and rate-sensitive areas, rather than concentrated exposure to AI-driven themes.

Fixed Income

The Fed left rates unchanged as they attempt to balance economic growth and elevated inflation.

The Fed held rates steady in January after cuts at three consecutive meetings (-0.25% each) to end 2025. The Fed is expected to cut rates one or two times in 20263 as they attempt to support job growth while keeping inflation at bay.

- Longer-term yields rose modestly amid the brewing geopolitical and trade tensions: Investors demanded higher yields on longer-term Treasuries as the U.S. clashed with NATO allies over Greenland. Robust GDP growth also put upward pressure on yields.

- Kevin Warsh was nominated to succeed Jerome Powell as the next Fed Chairman: The reaction in fixed income markets was muted as the appointment appeared to limit investor fears about political influence or loss of central bank independence. Warsh, a prior Fed Governor from 2006 – 2011, will take over in May if confirmed by the Senate.

Money and Metals

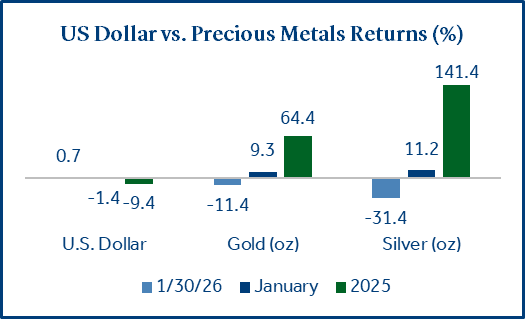

Continued dollar weakness boosted commodities’ prices, most notably in precious metals.

The U.S. dollar continued to weaken versus a basket of foreign currencies in 2026 and acted as a tailwind to commodity prices. Precious metals also rallied on fiscal concerns, geopolitical tensions, and strong demand.

- Dollar weakness deepened in January: The dollar fell -9.4% in 2025 and another -1.4% in January as rising U.S. debt, persistent inflation pressures, and lower global reliance pushed it to multi‑year lows. A number of foreign central banks continued to diversify away from the dollar, adding further pressure.

- Gold strength surged beyond the effect of currency weakness: Gold gained +64.4% in 2025 and an additional +9.3% in January as investors reacted to a weaker dollar, increased safe‑haven demand, stout foreign central‑bank purchases, and growing geopolitical concerns.

- Silver rallied due to high demand and tight supply: Silver soared +141.4% in 2025 and gained another +11.2% in January, supported by a global supply shortage and booming industrial demand from solar, semiconductors, electric automobiles (EVs), and AI hardware.

- Precious metals slide on the last trading day of the month: A rebound in the dollar, the appointment of Kevin Warsh as Fed Chair (viewed as a “safe” choice by markets), and heavy profit taking after the historic run, had a snowball effect on precious metals prices.

Geopolitical Events

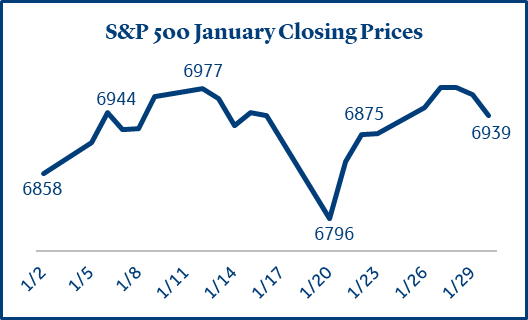

Tension between the U.S. and Greenland sparked the biggest one day drop in stocks since October.

Heightened geopolitical tensions stemming from events in Venezuela and friction between the U.S. and Greenland led to higher oil prices and short-term volatility in equity markets.

- Political instability in Venezuela pushed oil prices higher: U.S. special forces captured Venezuelan President Nicolas Maduro on January 3rd on accusations of narcoterrorism. Oil prices rose +3.2% the following week and +14.3% for the month as investors weighed the potential for global supply disruptions from the OPEC member.

- Tension between the U.S. and Greenland intensified over strategic resources and national defense: The U.S. has pushed for greater control over Greenland citing growing concerns over access to rare earth minerals and national security. On January 20th stocks registered their largest one-day drop (-2.1%) since October as the U.S. threatened higher tariffs on NATO member countries opposing an acquisition. Equities rebounded quickly as the U.S. softened its stance, ruling out military force but insisting a “framework deal” must be made for expanded U.S. military and mining presence in Greenland. It is important for investors to stay focused on their long-term goals and objectives. Historically, geopolitical events lead to increased market volatility in the early stages, but it often subsides quickly4.

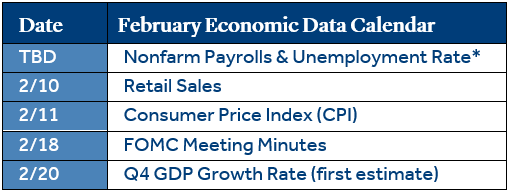

Economic Calendar

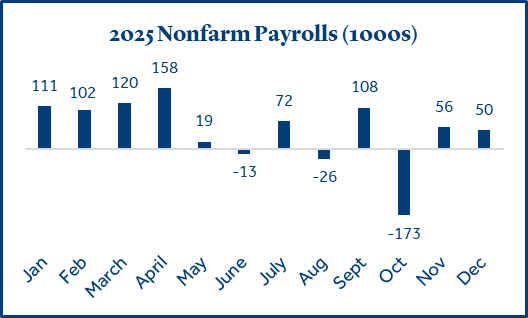

U.S. consumers remained resilient even as labor market conditions have eased.

Economic data continued to point to a resilient U.S. economy. The interpretation of recent data has been complicated by the government shutdown, which disrupted data collection in October and November, but the impact has been dissipating.

- Job growth was weaker than forecasted but the unemployment rate declined: December job growth (+50k) was below the forecast (+70k) and roughly flat with November’s gain (+56k). The two-month revision was deeply negative as new jobs were adjusted by -8k and -68k, respectively in November and October. The unemployment rate was 4.4%, better than the 4.5% forecast and last month’s rate of 4.6%.

- U.S. retail sales growth was resilient while consumer prices remained elevated: Retail sales for November grew +0.6% and exceeded the forecast (+0.4%). This was the highest rate since July and could suggest the economy continued to grow at a solid pace in the fourth quarter. Inflation rose +2.7% (annualized) in December, unchanged from November.

*The January jobs report will be delayed due to the partial government shutdown. The release, originally scheduled for 2/6, will be rescheduled upon the resumption of government funding.

To download the printable version, CLICK HERE.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Gov’t (Bloomberg Short Treasury), Interm Gov’t (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged), US Dollar (Performance of the US dollar against the following basket of currencies: euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc), Gold (DJ Commodity Gold), Silver (DJ Commodity Silver).

Treasury Yields sourced from the U.S. Department of the Treasury.

Nonfarm payrolls, unemployment statistics, and inflation (CPI) are sourced from the Department of Labor.

1 Source: Voya Investment Management

2 Source: Morningstar

3 Source: CME FedWatch Tool

4 Source: Mercer

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Fed Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS018119

7069921.21 (Exp. 12/27)