Monthly Market Commentary – January 2026

Monthly Market Commentary – January 2026

Market Update

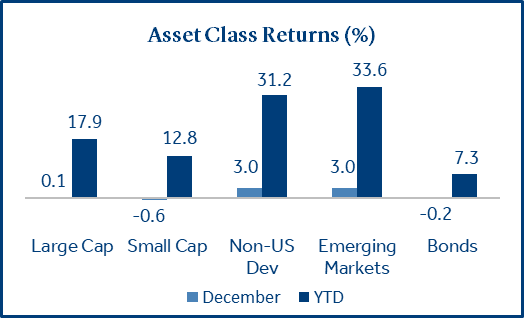

International markets led equity returns in December to close another strong year for stocks.

The S&P 500 delivered its eighth consecutive month of gains as economic data remained steady on rebounding job data and third quarter GDP growth (+4.3%) which reached the highest level in three years.

- Small caps gave up gains during year-end volatility: Large caps (S&P 500) gained +0.1% and topped small caps (Russell 2000) which declined -0.6%. Small caps led domestic equity returns for most of December, buoyed by a Fed rate cut, but surrendered their gains during a four-day losing streak to close out the year.

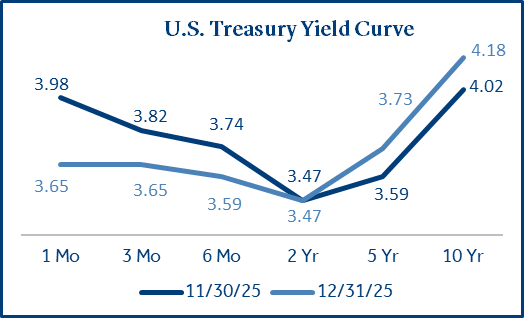

- Bonds dipped as strong economic growth (GDP) pushed yields higher: The Bloomberg US Agg Bond Index declined -0.2% as the 10-year Treasury yield increased from 4.02% to 4.18%. Mortgage-backed securities gained +0.2% while investment grade corporate bonds (-0.2%) and Treasuries (-0.3%) both declined.

- International stocks finish strong year with a December rally: European stocks (+3.9%) led developed market returns as GDP growth rebounded in the eurozone and UK. Emerging markets recovered losses from November as AI-related stocks propelled gains in both South Korea (+12.7%) and Taiwan (+5.8%).

Equities

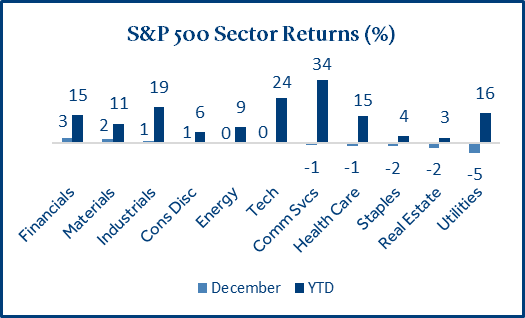

Fed policy has fueled a broader rally in U.S. equities, extending recent gains beyond AI stocks.

Recent Fed interest rate cuts sparked a rotation from AI-related stocks into more cyclical and interest rate sensitive sectors late in the year, including financials, materials, and industrials.

- Financial stocks rallied on lower short-term interest rates: The Fed’s December rate cut should improve liquidity and credit conditions, resulting in higher lending activity for banks and other diversified financials. Additionally, short-term rates fell more than long-term rates, which may improve bank profitability.

- Industrials and materials bounced on lower borrowing costs: These cyclical sectors are highly sensitive to interest rates and economic growth. Lower rates should reduce the costs of financing large-scale capital projects, upgrading machinery, and infrastructure development.

- Communication services & technology led sector returns for the third consecutive year: The primary driver of returns in 2025 was the artificial intelligence (AI) infrastructure buildout. Specifically, within technology, semiconductors “chip stocks” surged by +44%. Communication services stocks (Alphabet and Meta) benefited from the integration of AI into their consumer platforms and a rebound in digital advertising.

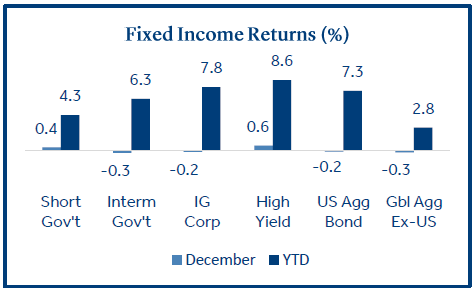

Fixed Income

Short-term yields dipped with the Fed rate cut while longer-term yields rose on strong economic growth.

The bond market has been navigating a transition in 2025 as Fed policy shifted from fighting inflation to supporting economic growth. As a result, Fed rate cuts have pushed short-term yields lower while longer-term yields remained elevated.

- A rise in longer-term yields could signal stronger investor confidence: A yield curve with short-term rates below long-term rates may imply lower recession concerns and highlight the Fed’s focus on growing the economy.

- High-yield corporate bonds outperformed in December: Because high-yield bonds typically have shorter maturities compared to investment-grade bonds and Treasuries, they were less impacted by the increase in long-term interest rates during the month.

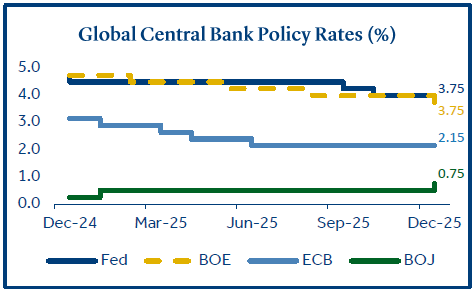

Global Central Bank Policy

Top central banks unleashed a wave of interest rate cuts in 2025 in an effort to boost global growth.

The largest central banks around the world lowered interest rates at the fastest pace since the Great Financial Crisis in 20081.

- The Fed delivered its third rate cut (-0.25%) this year in December: The widely anticipated move was described as “insurance” to protect against weaker job data. The Fed projected only one rate cut in 20262, reflecting its growing debate whether employment or inflation was a greater threat to the economy.

- European central banks lower rates to boost growth in 2026: The European Central Bank (ECB) and the Bank of England (BOE) also lowered rates in 2025. The ECB cut rates four times in the first half of 2025 in an effort to boost slumping economic growth. The BOE also cut four times, for similar reasons.

- The Bank of Japan (BOJ) hiked rates twice to the highest level in 30 years: The BOJ is the only major central bank to raise rates as it is attempting to normalize rates following three decades of low interest rate policies. The rate hikes were also seen as move to support the yen, which has weakened significantly against the U.S. dollar.

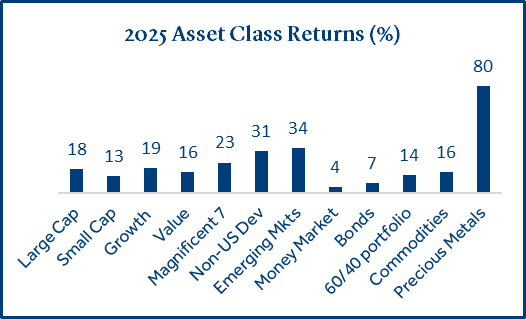

2025 Capital Markets Review

Asset class returns were broadly positive in 2025 led by international equities and precious metals.

Capital markets were resilient despite global trade policy uncertainty. Global monetary easing, record capital expenditures, strong corporate earnings, and robust GDP growth supported risk assets.

- International stocks (+31%) soared due to active fiscal policy and a weak U.S. dollar: Notable fiscal policy changes were enacted in Germany, Japan, and China while an increase in government spending on aerospace and defense was a theme across Europe. A -9.4% decline in the dollar compared to a basket of currencies also buoyed returns.

- AI-related stocks benefitted from a surge in capital expenditures: The acceleration in AI-related investments by the largest U.S. tech firms increased nearly 50% as Amazon, Microsoft, Alphabet, and Meta invested over $300 billon in AI infrastructure3.

- Precious metals shined in 2026 on strong demand: Gold returned +62% while Silver soared +139%. Global central bank rate cuts, budget deficit concerns, and rising investor demand for real assets drove returns.

- Bonds posted their best year since 2020: Easing Fed policy combined with elevated starting yields created a strong environment for fixed income assets. Higher bond coupons were able to cushion fixed income volatility even during periods of rising rates.

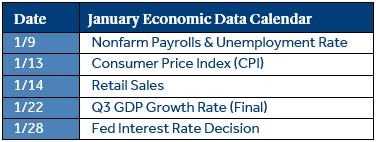

Economic Calendar

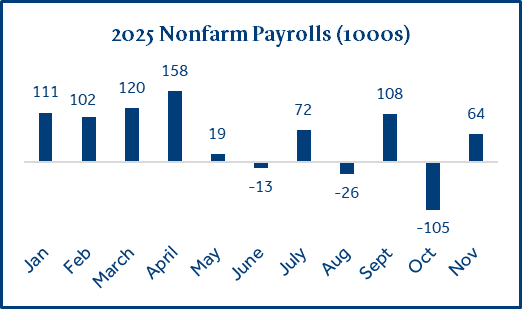

Overall economic growth (GDP) remains robust, but the labor market has showed signs of cooling.

The U.S. government shutdown resulted in nonfarm payroll reports for October and November each being delayed until mid-December.

- Job growth rebounded in November, but the unemployment rate rose to a four-year high: November job growth topped forecasts (+50k) but followed a turbulent October that saw -105k job losses, largely driven by a dip in government payrolls, due to the shutdown and deferred layoffs from earlier this year. Unemployment rose from 4.4% to 4.6% and the “job openings-to-unemployment” ratio fell below 1.0, meaning there are more job seekers than available jobs.

- The U.S. economy grew by +4.3% during the third quarter, much more than forecasted: GDP growth topped the forecast of +3.0% due to resilient consumer spending and a surge in AI-related business investment. The Atlanta Fed’s GDP model estimated that fourth quarter growth will be +3.0%4, suggesting the economy should continue to grow at a solid pace.

To download the printable version, CLICK HERE.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Gov’t (Bloomberg Short Treasury), Interm Gov’t (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged). Growth (Russell 1000 Growth), Value (Russell 1000 Value), Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla), Money Market (FTSE Treasury Bill 3 month), 60/40 portfolio (60% S&P 500 / 40% US Aggregate Bond), Commodities (Bloomberg Commodity), Precious Metals (Bloomberg Sub Precious Metals).

Treasury Yields sourced from the U.S. Department of the Treasury.

Nonfarm payrolls, unemployment statistics, and inflation (CPI) are sourced from the Department of Labor.

1 Source: Reuters

2 Source: Federal Reserve Board

3 Source: JPMorgan Asset Management

4 Source: Federal Reserve Bank of Atlanta (as of December 23, 2025)

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Fed Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS018129

7069921.20 (Exp. 12/27)