Monthly Market Commentary – July 2025

Monthly Market Commentary – July 2025

Market Update

U.S. stocks reached an all-time high in June even as geopolitical risks remained elevated.

Despite heightened tensions between Israel and Iran, weak U.S. retail sales data, and a Federal Reserve (Fed) that remained on hold, domestic stocks rallied as investors focused on strong jobs data and better than expected corporate earnings. Against this backdrop:

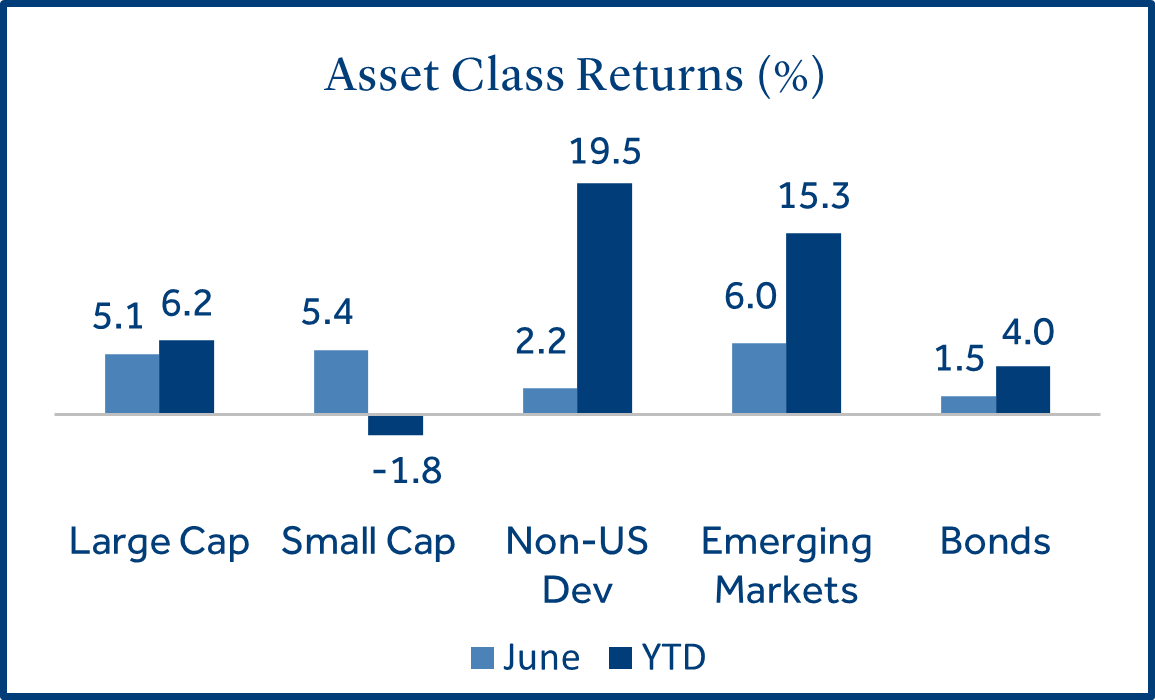

- Domestic small caps outpaced large caps: Small cap stocks (Russell 2000 Index) gained +5.4% and outperformed large caps (S&P 500 Index) which returned +5.1%. Smaller stocks may have outperformed on hopes of future rate cuts and easing geopolitical tension.

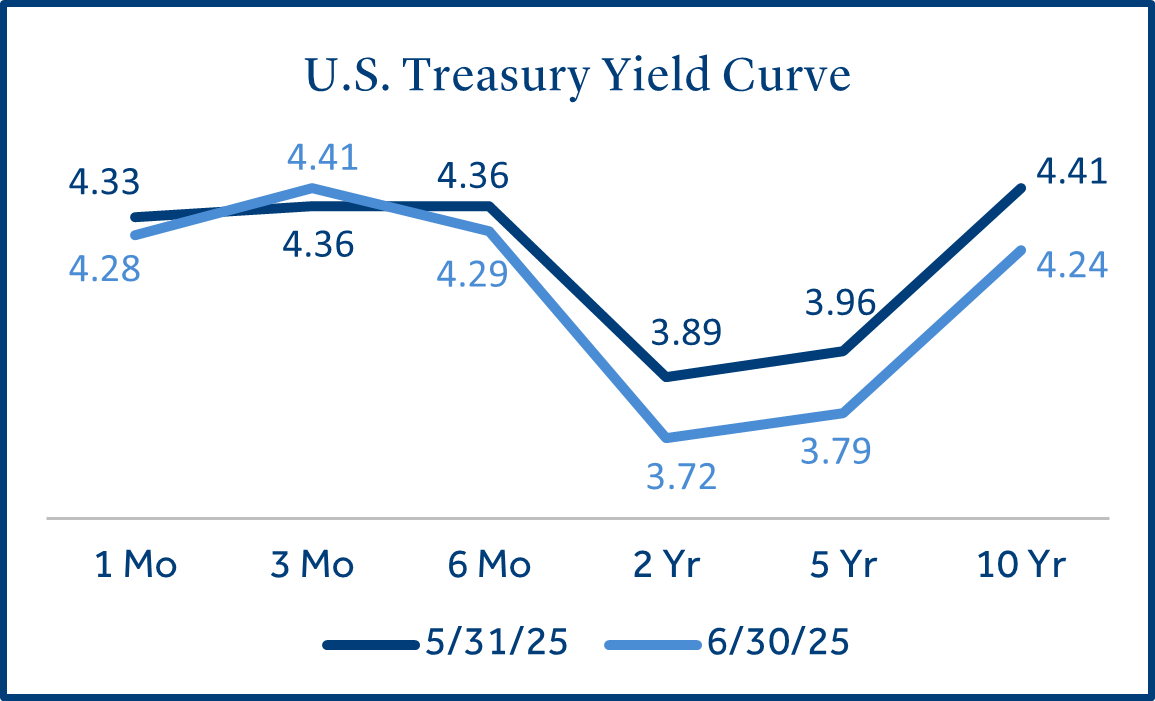

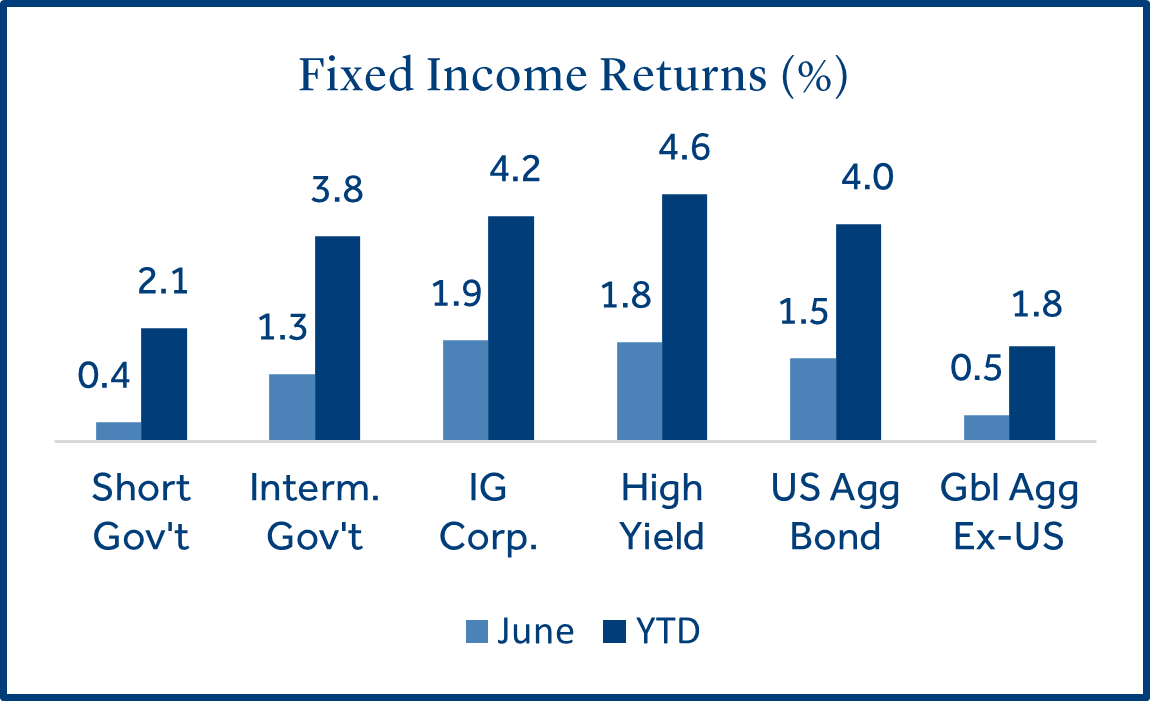

- Bond returns were positive as interest rates declined: Bonds (Bloomberg U.S. Aggregate Bond Index) returned +1.5% as the 10-year yield dipped from 4.41% to 4.24%. Investment grade corporate bonds gained +1.9% during June to outpace mortgage-backed securities (+1.8%) and U.S. Treasuries (+1.3%).

- Emerging markets beat non-US developed markets: Emerging markets stocks (MSCI EM Index) gained +6.0% and topped non-U.S. developed markets (MSCI EAFE Index) which returned +2.2%. Taiwan (+9.4%) outperformed due to exposure to the rising technology sector while Brazil (+7.8%) benefitted from stability in monetary policy and fiscal reforms.

Equities

U.S. equities posted gains on easing trade tension between the U.S. and China.

Domestic stocks rallied for the second consecutive month on optimism around global trade. The S&P 500 Index has now fully recovered from a -18.8% correction earlier this year.

- The U.S. and China agreed to a trade deal in principle: Terms of the deal provide the U.S. with access to rare earths required for key technologies while the U.S. would lift restrictions on certain U.S. goods entering China. Tariffs on Chinese goods would expand to 55% (up from 30%) while Chinese tariffs on U.S. goods would remain at 10%. The deal is pending approval from both countries. The U.S. warned in June that countries without a trade deal in place could face tariff hikes on July 9th.

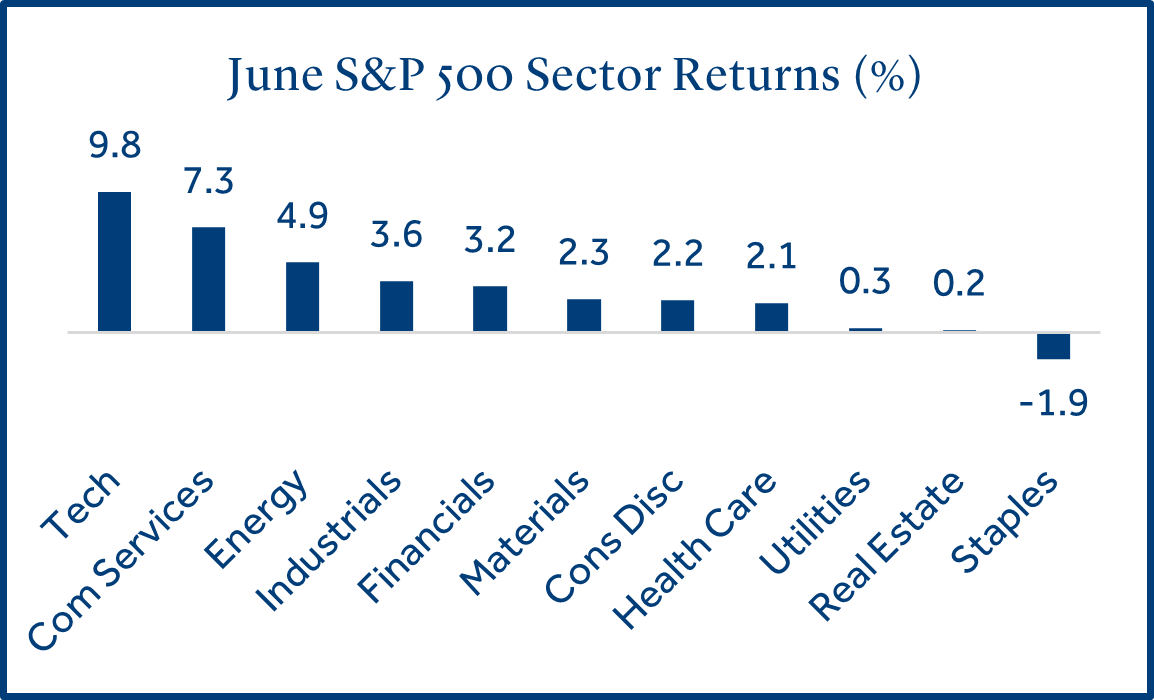

- Strong demand for artificial intelligence (AI) pushed technology stocks higher: The tech sector outperformed for the third consecutive month. Semiconductor “chip” stocks led returns in June as more firms raised expectations for AI applications and cloud computing infrastructure continued to expand.

- Rising oil prices boosted the energy sector: Israeli air strikes on Iran and the potential for global supply disruptions sent oil prices higher by 9.1% in June. Further, the demand for natural gas has increased due to its potential as a power source for data centers supporting AI.

Fixed Income

Bond returns were strong as conflict in the Middle East contributed to demand.

Treasury yields moved lower in June following the unrest in the Middle East, but it was not a dramatic decline that can often follow geopolitical events. The rising budget deficit and recent downgrade of U.S. Treasury debt could be balancing out some of the downward pressure on yields.

- Long-term rates fell more than short-term rates: Shorter-term yields, which are highly sensitive to Fed policy, were relatively flat as the Fed continued to take a “wait and see” approach to lower rates. Longer-term yields likely declined due to increased demand for safe-haven assets due to rising geopolitical tension and slowing economic data.

- Corporate bonds of all qualities posted gains: Strong fundamentals and attractive yields have supported demand for corporate debt. In the event of an economic slowdown, established firms with high credit ratings and low refinancing risk may be better positioned.

Federal Reserve

As expected, the Fed held short-term rates steady during its June policy meeting.

The Fed stated that economic activity has continued to expand at a solid pace although wide swings in exports have affected the data. During June, the unemployment rate remained low, and labor market conditions remained solid, but inflation remained somewhat elevated.

- The Fed projected two 0.25% rate cuts this year at their June meeting: This forecast is in line with the last two policy meetings. However, there have been growing differences among FOMC participants in recent months, as seven of the 19 members forecasted zero rate cuts this year during the June meeting, up from only four in March1.

- Chair Powell said a higher inflation outlook has led to the Fed’s inactivity: The central bank is waiting for more clarity on the economic effect of the President’s tariffs before lowering interest rates. The inflationary effect of tariffs is largely dependent upon where tariff rates settle. For now, the Fed believes the economy is well-positioned to see if inflation stabilizes.

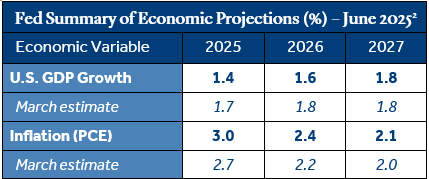

- The Fed lowered their GDP growth estimate while revising their inflation estimate higher: The Fed’s summary of economic projections released in June suggested the U.S. economy may be headed for a period of stagflation, a period of slowing growth and rising inflation. The Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index, is expected to end 2025 at 3%, well above the Fed’s December projection (+2.5%).

Israel-Iran Conflict

Conflict between Israel and Iran escalated and has raised concerns about the risk of a broader war.

First and foremost, our thoughts go out to those affected by recent events in the Middle East. The conflict between Israel and Iran is far too complex to cover in detail here and therefore we focused on the possible market implications of recent events.

- The Israel-Iran conflict intensified in June: Israel launched an air attack targeting nuclear weapon facilities in Iran on June 13th. The U.S. became involved on June 21st by leading air strikes targeting three Iranian nuclear facilities in an attempt to prevent Iran from developing a nuclear weapon. A ceasefire between Israel and Iran was announced on June 24th.

- Oil prices jumped 9% in June on potential supply disruptions: Iran accounts for 4% and the Middle East accounts for almost one-third of the global oil supply. If the region becomes divided, the impact to the global oil supply is uncertain. Additionally, the Strait of Hormuz supports almost 20% of the global oil supply and Iran’s proximity to the area poses the risk of transport and supply disruptions.

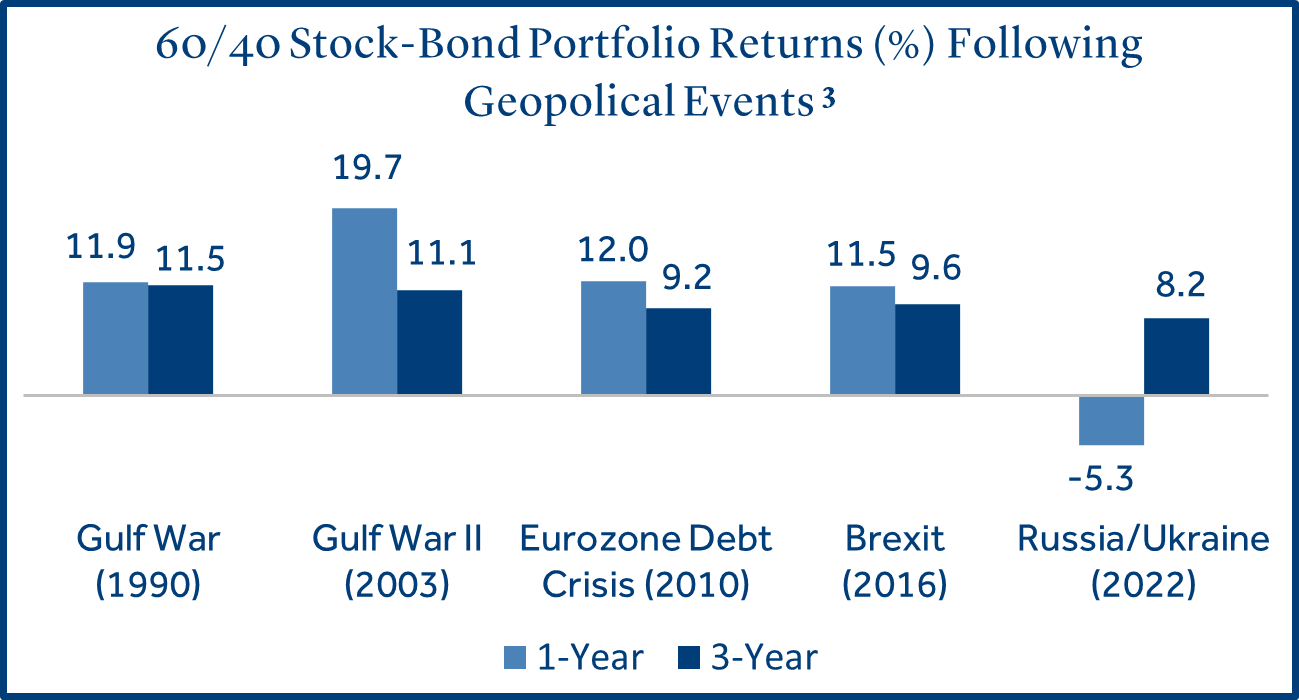

- Investors should prepare for uncertainty but maintain their investment discipline: Historically, geopolitical events have led to market volatility in the initial stages, but it often subsides over longer periods. Maintaining a diversified portfolio aligned with investor goals and risk tolerance has been an effective approach historically.

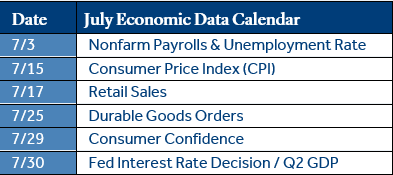

Economic Calendar

U.S. job growth slowed but remained in economic expansion territory.

U.S. GDP data slowed somewhat but has remained resilient. Jobs continued to grow at a steady pace, the unemployment rate has shown little evidence of weakness, and although inflation edged higher, it remained near a three-year low. Also in focus is the President’s $3.3 trillion tax and spending package. A modified version of the bill passed the Senate, but it now returns to the House for another vote as both chambers must pass the same legislation.

- Job growth exceeded expectations: nonfarm payrolls increased by +139k in May, above the forecast (+125k), but slightly below the +147k new jobs created in April (revised down from +177k). Employee wages, a closely watched inflation indicator, rose +3.9% on an annualized basis, exceeding the forecast (+3.7%).

- Retail sales declined more than anticipated: Spending declined in May by -0.9% even as consumer confidence rebounded. It was the worst decline in monthly sales since January. However, excluding auto dealerships, building materials suppliers, and gas stations, sales rose +0.4%. This positive reading, referred to as the control group, is the input in calculating GDP1.

- The Consumer Price Index (CPI) increased modestly but was in line with the forecast: Prices rose by +2.4% (annualized) in May as expected. This was a modest increase over the +2.3% rise in April but still one of the lowest prints over the past several years. Although inflation continued to register above the Fed’s 2% target, investors took some relief in the data as the impact from new tariffs appeared modest.

Click here for a download of the full commentary.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Gov’t (Bloomberg Short Treasury), Interm Gov’t (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged).

Treasury Yields sourced from the U.S. Department of the Treasury.

Inflation (CPI) sourced from the U.S. Bureau of Labor Statistics.

Unemployment statistics sourced from the Department of Labor.

1 Source: Bloomberg

2 Source: Federal Reserve Board

3 Source: Morningstar Direct. Portfolio returns reflect allocations of 60% in the S&P 500 Index and 40% in the Bloomberg Aggregate Bond Index. 3-year returns are annualized. Past performance is not a reliable indicator of future results.

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Durable Goods measure the cost of orders received by U.S. manufacturers of goods meant to last at least three years.

Fed Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS12603

7069921.13 (Exp. 6/27)