Monthly Market Commentary – May 2025

Monthly Market Commentary – May 2025

Monthly Market Commentary – May 2025

Market Update

Tariffs created headwinds for U.S. stocks in April leading to further outperformance for international stocks.

The S&P 500 Index nearly entered “bear market” territory as the index declined -19% between February 19th and April 8th (a “bear market” is a -20% decline in stocks). Uncertainty around U.S. trade policy, slowing economic growth, and the potential for higher inflation contributed to the decline in stocks. Against this backdrop:

-

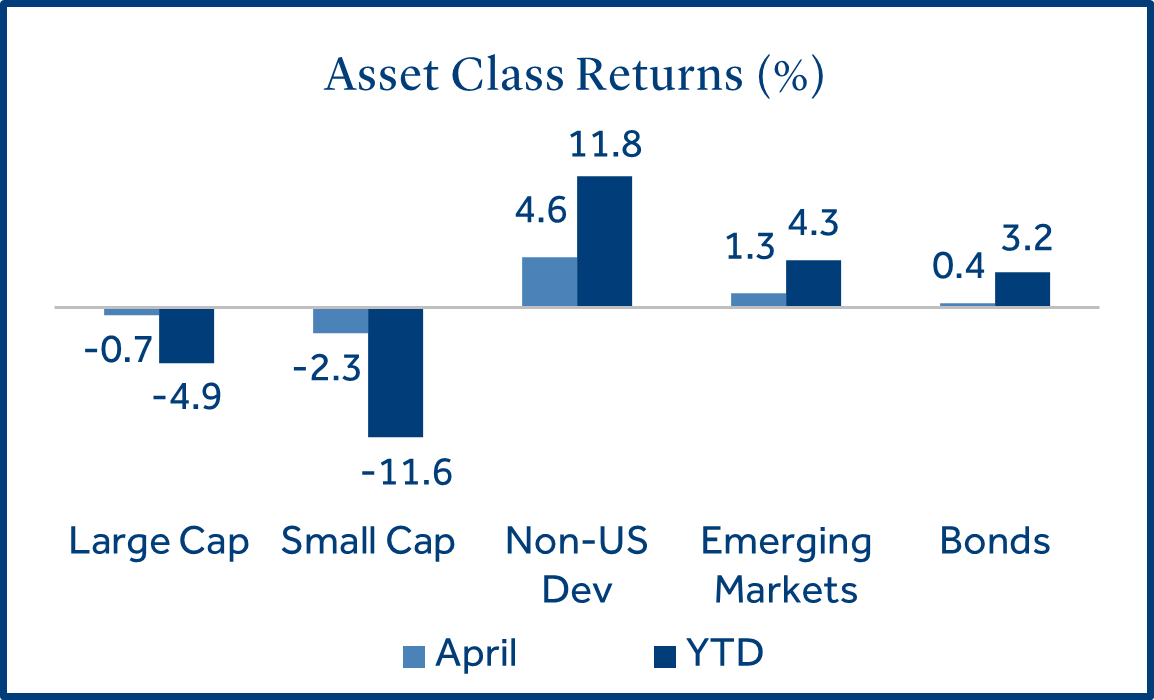

U.S. stocks underperformed as recession risks increased: Large cap stocks (S&P 500 Index) declined -0.7% but outperformed small caps (Russell 2000 Index) which lost -2.3%. Larger than expected tariffs announced in April were a key driver of the decline, as it led to uncertainty for businesses and investors.

-

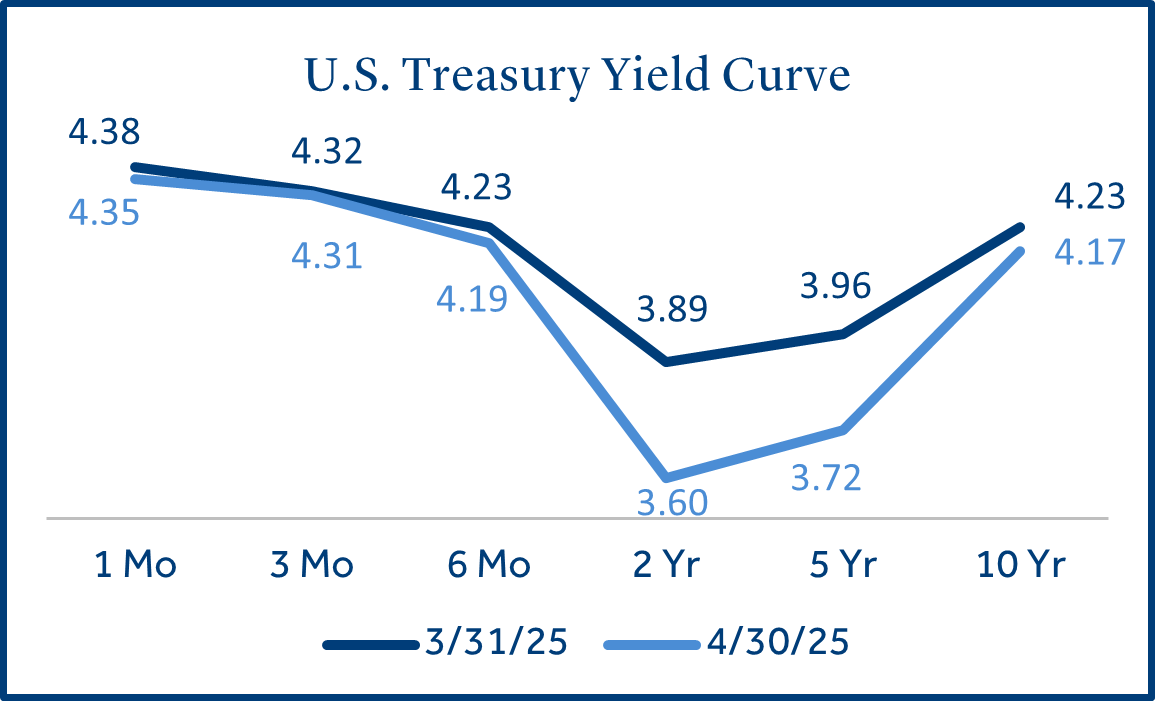

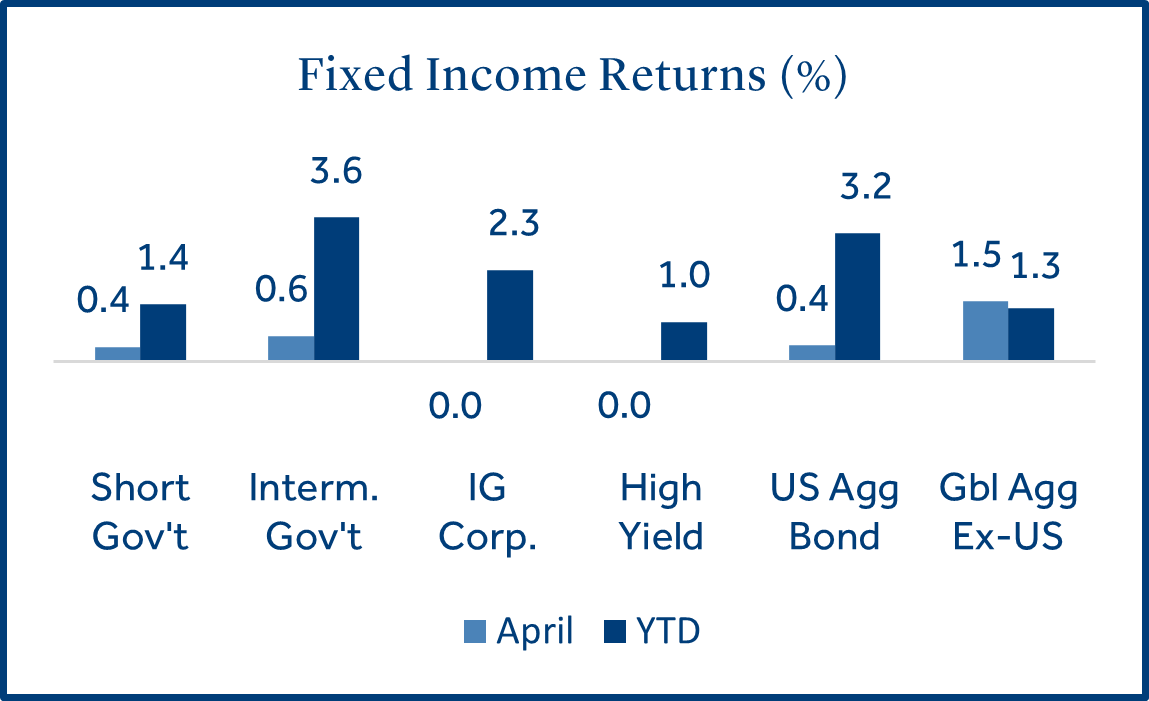

Bond returns were positive as interest rates declined: Bonds (Bloomberg US Aggregate Bond Index) returned +0.4% as the 10-year U.S. Treasury yield dropped from 4.23% to 4.17% (-0.06%).

-

International stocks outperformed the U.S. for the fifth consecutive month: Developed markets (MSCI EAFE Index) gained +4.6% and topped emerging market stocks (MSCI EM Index) which gained +1.3%. European stocks moved higher on expectations for an increase in defense spending and an optimistic tone on inflation from the European Central Bank.

Equities

Large cap technology stocks rebounded in late April as trade tensions eased.

Stocks experienced heightened volatility as tariff-related headlines created uncertainty across market sectors. Stocks declined -11.2% April 1st through the 8th before rallying +11.8% between April 9th and month end.

-

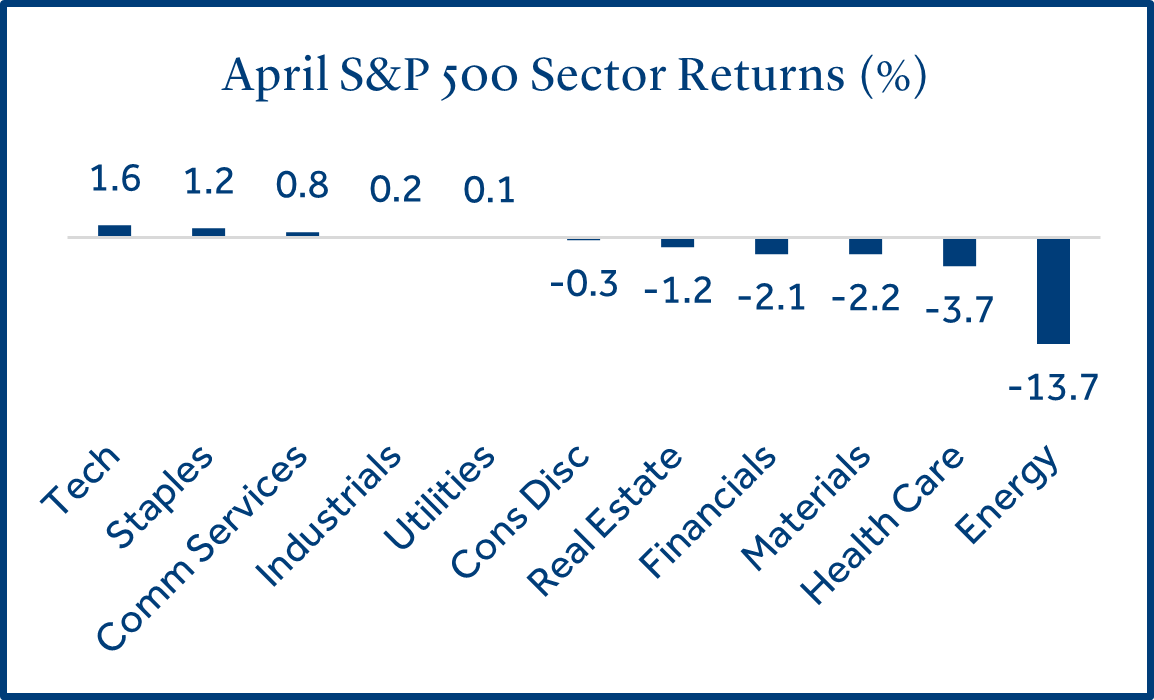

Technology stocks rebounded in April: Tech stocks rallied to a positive gain (+1.6%) during April after a pause on reciprocal tariffs April 9th. Easing trade tensions and positive earnings results from Alphabet supported the rebound. Additionally, Microsoft and Meta each reported financial results after the market closed on April 30th that exceeded investor expectations.

-

Earnings results for the S&P 500 were better than feared to start the first quarter: With 180 firms reporting earnings, 73% beat estimates, which is slightly below the five-year average (75%). However, reported earnings overall were +10.0% above estimates, which is above the five-year average of +8.8%1. Strong corporate earnings could provide crucial support to stocks amid economic uncertainty.

-

Energy stocks underperformed as oil prices declined: Oil prices sank -18% in April, for the largest one-month drop since November 2021. The demand for oil has declined rapidly due to U.S.-China trade tension, slowing economic growth, and increasing production from OPEC+.

Fixed Income

Bond returns were mostly positive as longer-term interest rates declined.

Interest rates were highly volatile in April before ending the month slightly lower. The 10-year yield declined -0.20% following the tariff announcements on April 2nd, then moved +0.50% higher over the next five days before ending the month -0.06% lower. Theories around the spike in rates included foreign central banks selling treasuries, the growing U.S. budget deficit, and hedge fund repositioning2.

-

Short-term rates were stable as the Fed is expected to leave rates unchanged in May: Interest rate futures indicate a 90% probability that rates will remain unchanged during the Fed’s May policy meeting3. However, a recent dip in the two-year yield could signal some investors expect the Fed to move more quickly with rate cuts in the second half of the year.

-

Higher quality bonds outperformed year-to-date: Outperformance from investment grade bonds versus high yield bonds could indicate investor risk appetite has declined.

Tariffs

The U.S. announced a 90-day pause on reciprocal tariffs with all nations expect for China.

The pause for most country specific tariffs raised hopes that global trade tensions would de-escalate. However, a 10% universal tariff on all countries and a 145% tariff on Chinese goods remained in effect.

-

China was excluded from the tariff pause due to its retaliatory tariffs on U.S. goods: China responded to newly levied U.S. tariffs by enacting tariffs on U.S. goods (125%). The pause on reciprocal tariffs for most countries was granted as a reward for not raising tariffs on the U.S.

-

Tariffs may create challenging environment for the Fed: Fed Chair Jerome Powell stated the tariffs announced so far have been “significantly larger than anticipated,” adding their impact on inflation and economic growth could also be significant. Should the negative economic effects materialize while inflation remains elevated, the Fed could find itself in a challenging position.

-

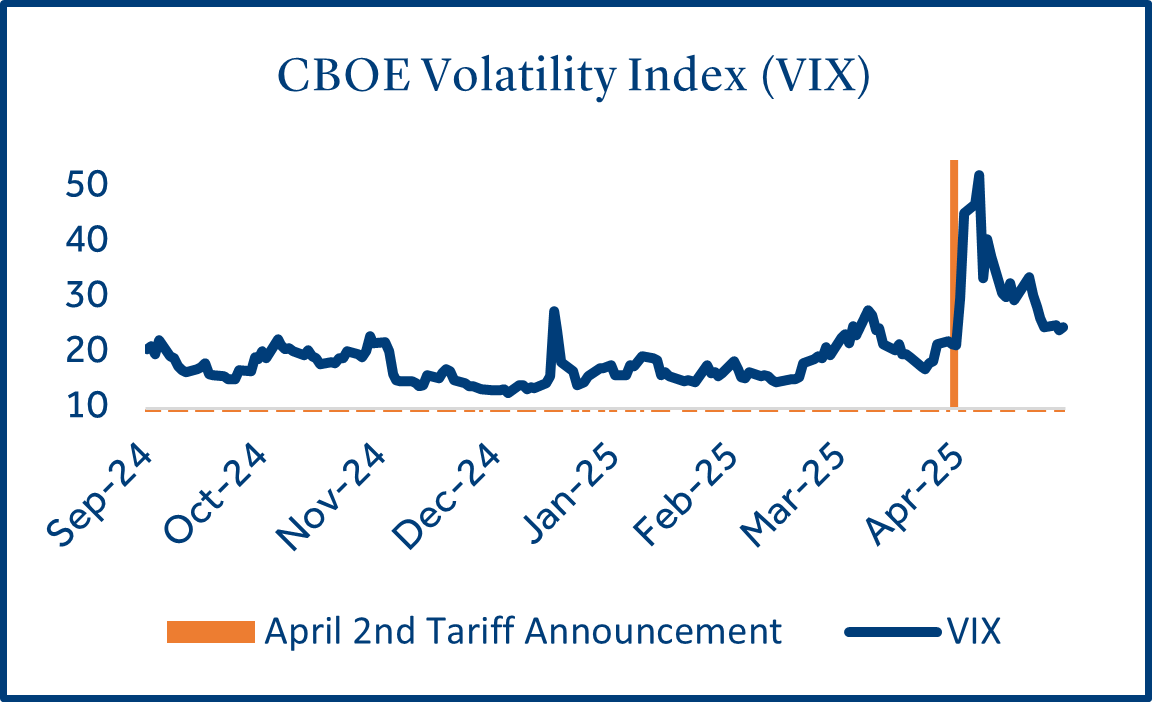

Uncertain trade policy has led to elevated market volatility: Following the announcement of new tariffs on April 2nd, the volatility index (VIX) reached levels not seen since 2020. Gold (+6% in April) and government bonds provided a haven for investors while international stocks added diversification benefits to portfolios. Now is a great time to ensure investor allocations are aligned with their time horizon, risk tolerance, and financial goals.

Recession Watch

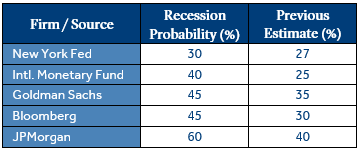

Several firms have raised their expectations for a U.S. economic recession.

The Federal Reserve updated their forecasts to reflect expectations for slower economic growth and higher inflation at their March policy meeting. Since that time, several other firms have followed their lead as the impact of tariffs remains uncertain.

-

Economic growth slowed during the first quarter: The commerce department said that 1st quarter gross domestic product (GDP) fell -0.3% (annualized), well below the 4th quarter (+2.4%) level. It was the weakest growth rate for the U.S. economy in three years4.

-

Consumer and business sentiment have continued to worsen: Consumer sentiment declined for the fourth consecutive month in April as investors expressed concerns about the economic impact of tariffs and a possible return to higher inflation. Consumers expect prices to rise +6.5% over the next year, the highest level since 1981. In a recent survey of 300+ U.S. CEOs, 62% said they expect an economic slowdown or recession in the next six months, up from 48% last month5.

-

Several firms have raised their estimated probability for a U.S. economic recession: Contributing factors included the negative effect of tariffs on economic growth, possible retaliatory measures from other countries, and the potential for higher inflation. Negotiations will be key during the 90-day tariff pause. If rates announced on April 2nd go into effect, the tariff rate on foreign goods is likely to average between 20-25%, which would be the highest level since 19046.

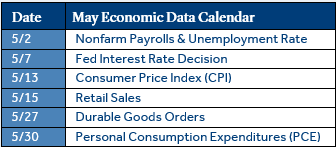

Economic Calendar

The labor market continued to be resilient and could be the key for continued economic growth.

Although economic growth weakened and sentiment has deteriorated, not all is bad for the U.S. economy. Unemployment claims have been steady and job growth remains at levels generally associated with economic expansion (+100k). Continued strength in the labor market should support consumer spending, which accounts for two-thirds of GDP.

-

Recent job growth exceeded expectations: New jobs created in March totaled +228k, above the forecast for +140k and significantly higher compared to February (+117k). The report provided temporary relief to investors as many economists have pointed to the labor market as the key to further U.S. economic growth. April job growth (+177k) was reported on May 2nd and was also stronger than expected (+133k). The unemployment rate held steady at 4.2%.

-

Retail sales rebounded in March: Consumer spending increased by +1.4% and was better than the forecast of +1.2% and far exceeded February (+0.2%). Some economists expected a large jump in automotive sales as consumers tried to make purchases ahead of the tariffs. However, retail sales, excluding automobiles, were also stronger than forecast.

-

CPI inflation declined for the second straight month: Prices rose by +2.4% (annualized) in March, less than the forecast (+2.6%) and below February (+2.8%). The core inflation rate, which excludes volatile food and energy prices, fell to +2.8%, which was the lowest rate since March 2021.

Click here for a doanload of the full commentary.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Gov’t (Bloomberg Short Treasury), Interm Gov’t (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged).

Treasury Yields sourced from the U.S. Department of the Treasury.

Inflation (CPI) sourced from the U.S. Bureau of Labor Statistics.

Unemployment statistics sourced from the Department of Labor.

1 Source: FactSet

2 Source: Fidelity

3 Source: CME FedWatch Tool

4 Source: Bloomberg

5 Source: Chief Executive, CNBC

6 Source: Morningstar

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Durable Goods measure the cost of orders received by U.S. manufacturers of goods meant to last at least three years.

Fed Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS12603

7069921.11 (Exp. 4/27)