Monthly Market Commentary – October 2025

Monthly Market Commentary – October 2025

Market Update

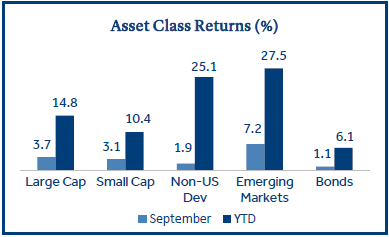

September delivered positive returns across asset classes, with emerging markets leading the way.

The S&P 500 notched a record high for the fourth straight month as the Federal Reserve (Fed) made its first rate cut since 2024. The move sparked rallies in U.S. stocks, emerging markets, and bonds. While job growth slowed, consumer spending remained resilient, setting the stage for a dynamic month.

- Large caps edged out small caps as tech outperformed: The S&P 500 gained +3.7%, slightly ahead of the +3.1% return from small caps (Russell 2000). Tech stocks held up well despite a modest end-of-month pullback, likely driven by profit-taking after a strong run.

- Bond markets rallied as yields dipped: The Bloomberg US Aggregate Bond Index returned +1.1%, as the 10-year Treasury yield fell from 4.23% to 4.16%. Corporate bonds led sector returns (+1.5%), followed by mortgage-backed securities (+1.2%) and Treasuries (+0.9%).

- Emerging markets surged on U.S. dollar weakness: The MSCI EM Index rose +7.2% during the month, far outpacing the +1.9% from developed markets (MSCI EAFE). A soft dollar in 2025 has boosted local currency returns and eased debt burdens for EM economies.

Equities

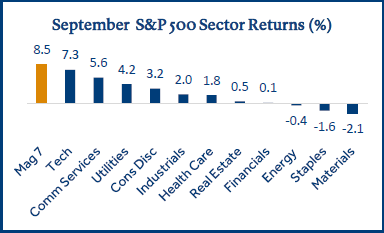

Technology continued to lead stocks higher as AI investment momentum builds.

Domestic equities extended their winning streak to five months post-April’s correction. The S&P 500 now trades at 23x forward earnings, a 20% premium to its 10-year average¹. Still, optimism around tax policy, Fed rate cuts, and corporate earnings growth has kept investors engaged.

- Small caps shine in Q3: Small caps returned +12.4% and outpaced large caps (+8.1%) due to their sensitivity to economic growth and lower interest rates. The average P/E ratio of 16x for small caps remains well below large caps (23x), which could offer more potential upside.

- The “Magnificent Seven” stocks drove tech sector gains in September²:

- Alphabet (Google parent) rallied +14% after a favorable antitrust ruling.

- Apple surged +10% on strong iPhone sales.

- Tesla soared +33% following Elon Musk’s $1 billion stock purchase. - Growth and momentum factors drove equity returns: Fueled by enthusiasm around AI, tech stocks outperformed. Consulting firm McKinsey & Company estimates $5.2 trillion will be spent globally on data center infrastructure by 2030.

U.S. Government Shutdown

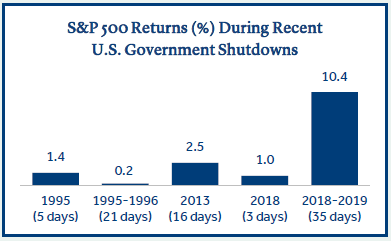

Previous shutdowns have not had a significant impact on economic growth or capital markets.

The government’s fiscal year begins on October 1st, and each year Congress must approve a new budget. A shutdown occurs when lawmakers are unable to reach an agreement. The key issue that led to the 2025 shutdown was health care funding.

- 900k federal workers could be furloughed: Government employees deemed critical to public safety or national security will continue to work while government reported economic data such as nonfarm payrolls and CPI will likely be suspended.

- The impact on economic growth has been modest in the past: The estimated effect on GDP ranges from -0.1% to -0.2% per week of

shutdown. A Congressional Budget Office study indicated the 35-day shutdown in 2018- 2019 shaved -0.4% from economic output. - Capital markets have been resilient during recent shutdowns: Volatility could increase due to uncertainty, but it has generally been short-term. During the shutdown in 2018-2019 the S&P 500 dropped -2.7% on the first day but quickly rebounded and posted a strong gain of +10.4% over 35 days.

Federal Reserve

The Fed initiated a long-anticipated rate cut in September, citing weakness in U.S. job growth.

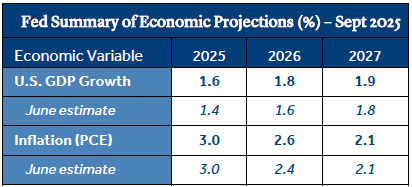

At its September policy meeting, the Fed lowered its benchmark interest rate by -0.25%, bringing the target range to 4.00–4.25%. The move was widely expected and marked the first cut since December 2024. Fed Chair Jerome Powell described the move as “risk management” amid growing economic uncertainty.

- Labor market weakness was the primary driver: Powell noted that nonfarm payroll growth has slowed significantly, averaging just +29k per month since June. This deceleration, paired with rising inflation, created a “curious balance” that prompted the Fed to act.

- Two more cuts are likely in 2025: The Fed’s Summary of Economic Projections suggests a year-end target range of 3.50–3.75%, implying two additional -0.25% cuts. The committee’s September vote was nearly unanimous (11–1), signaling strong consensus.

- Inflation remains stubbornly high: Despite slowing job growth, inflation (PCE) is projected to remain at +3.0% in 2025, above the Fed’s long-term target (+2.0%). This may complicate policy decisions, as further easing could risk reigniting price pressures.

Historical Interest Rate Cycles

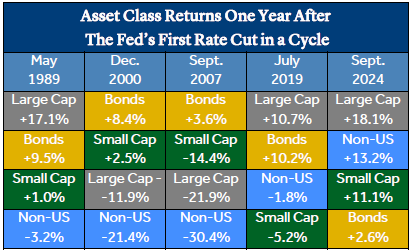

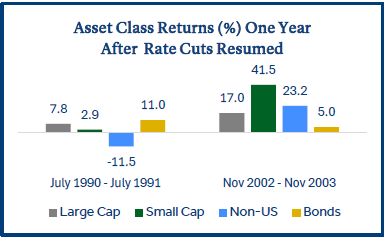

History shows bonds tend to benefit from Fed easing, while equity performance has varied.

Since 1989, there have been five distinct Fed rate cut cycles. The September 2025 cut could mark the start of a new cycle or a continuation of the 2024 path, which paused for nine months. Either way, historical data offers valuable insight.

- Bond returns have been positive: In every cycle, bonds have delivered gains in the year following the initial rate cut, reflecting investor demand for yield when rates are declining.

- Equity returns have been mixed: Stocks performed well in 1989, 2019, and 2024, but declined sharply in 2000 and 2007 as those cuts preceded recessions. The timing and severity of economic downturns play a critical role in equity outcomes.

- Cycles with long pauses still saw gains: The 1989 and 2000 cycles included pauses of over six months between cuts, similar to the 2024–2025 gap. In both cases, returns were mostly higher after cuts resumed.

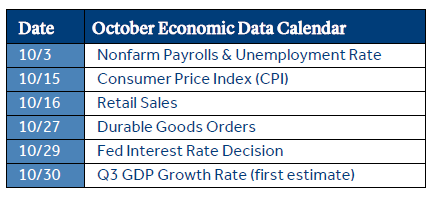

Economic Calendar

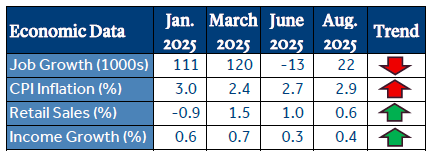

Second-quarter GDP rebounded sharply, but labor market data raises questions about the sustainability of growth.

U.S. GDP grew at an annualized rate of +3.8% in Q2, reversing the -0.6% contraction from Q1. This marks the strongest quarterly growth rate since mid-2023, driven primarily by robust consumer spending, which accounts for roughly 70% of GDP.

- The labor market showed signs of fatigue: After strong gains in early 2025, nonfarm payrolls turned negative in June (-13k) and only modestly recovered in August (+22k). Slowing job growth has sparked concerns about a potential rise in unemployment.

- Consumer spending remains a bright spot: Despite labor market softness, retail sales and income growth have held up. Americans appear confident in their job security, with layoffs remaining low. However, the pace of spending has slowed modestly, and future growth may hinge on continued consumer resilience.

- Futures markets indicate a 99% probability that the Fed will cut rates -0.25% in October3: The Fed could have the opportunity to see almost a full month of additional economic data (pending resolution of the shutdown) prior to their rate decision in late October.

To download the printable version, CLICK HERE.

Data and rates used were indicative of market conditions as of the date shown. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. This material is intended for general public use and is for educational purposes only. By providing this content, Park Avenue Securities LLC is not undertaking to provide any recommendations or investment advice regarding any specific account type, service, investment strategy or product to any specific individual or situation, or to otherwise act in any fiduciary or other capacity. Please contact a financial professional for guidance and information that is specific to your individual situation. Indices are unmanaged and one cannot invest directly in an index. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof. Past performance is not a guarantee of future results.

All investments involve risks, including possible loss of principal. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high yield bonds are subject to greater price volatility. Investing in securities of smaller companies tends to be more volatile and less liquid than securities of larger companies. Investing in foreign securities may involve heightened risk including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information and changes in tax or currency laws. Such risks are enhanced in emerging markets.

Asset class returns sourced from Morningstar Direct. Asset categories listed correspond to the following underlying indices: Large Cap (S&P 500), Small Cap (Russell 2000), Non-US Dev (MSCI EAFE), Emerging Markets (MSCI EM), Bonds (Bloomberg US Aggregate Bond), Short Gov’t (Bloomberg Short Treasury), Interm Gov’t (Bloomberg US Treasury), IG Corp (Bloomberg US Corp. Bond), High Yield (Bloomberg High Yield Corporate), Global Agg ex-US (Bloomberg Global Agg Ex US – Hedged).

Treasury Yields sourced from the U.S. Department of the Treasury.

Nonfarm payroll, unemployment, and inflation (CPI) data sourced from the U.S. Bureau of Labor Statistics.

1 Source: FactSet

2 Source: Morningstar (magnificent seven stocks include Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla)

3 Source: CME FedWatch Tool

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, and is a commonly used measure of the rate of inflation.

Retail Sales represents the level of retail sales directly to U.S. consumers.

Durable Goods measure the cost of orders received by U.S. manufacturers of goods meant to last at least three years.

Fed Funds Rate: Short-term target interest rate set by the Federal Open Market Committee (FOMC); the policy making committee of the Federal Reserve. It is the interest that banks and other depository institutions lend money on an overnight basis.

S&P 500 Index: Index is generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

Russell 2000 Index: Index measures performance of the small-cap segment of the U.S. equity universe.

MSCI EAFE Index: Index measures the performance of the large and mid-cap segments of developed markets, excluding the U.S. & Canada.

MSCI EM Index: Index Measures the performance of the large and mid-cap segments of emerging market equities.

Bloomberg US Aggregate Bond Index: Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

Park Avenue Securities LLC (PAS) is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian). 10 Hudson Yards, New York, NY 10001. PAS is a registered broker-dealer offering competitive investment products, as well as a registered investment advisor offering financial planning and investment advisory services. PAS is a member of FINRA and SIPC.

PAS018129

7069921.17 (Exp. 9/27)